1) Figure out your business name.

2) Register your business name with GoDaddy.com.

3) If you can afford it – register your business as an S Corp or LLC from day one. Budget $300 to $400 if you use a service like LegalZoom.com.

4) The same is true for your trademark. If funds are tight I would at least file the LLC or S Corp and hold on the Trademark.

5) If you register a different LLC or S Corp entity name than the name you plan to call your business you must file a DBA (use LegalZoom.com).

6) If you can’t afford to form an LLC or S Corp register for an assumed name certificate at the county courthouse. You can use your social security number. As soon as you can afford it… file to become an LLC or S Corp.

7) Setup your business bank accounts from day one. They are nearly free. This is very important. First file as an S Corp or LLC or Sole Proprietor or Partnership (Assumed Name Certificate at the courthouse) and then visit the bank and setup your business bank accounts.

8) If offered, take the credit card the bank offers with your business account but do not use it. File it away only to be used for emergencies. Debt (too many high monthly payments) runs more small business owners out of business than you would expect).

9) If you are starting your business with a partner consider a Buy Sell Agreement.

10) File for a sales tax permit. (you can generally do this online in your local city)

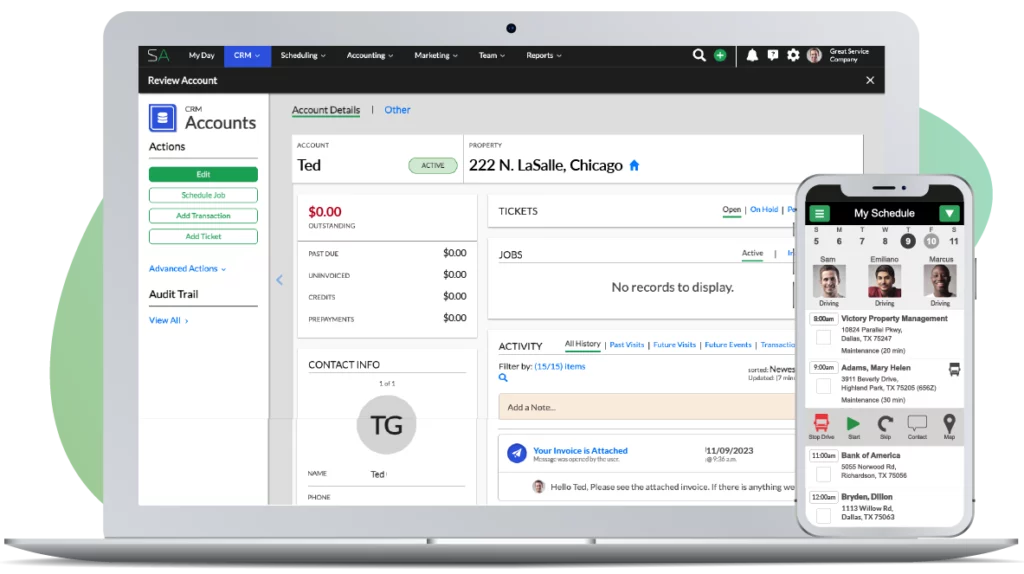

11) Look for a great inexpensive software tool that has the potential to run all facets of your business as you grow. Obviously we recommend Service Autopilot (http://www.LawnServiceSoftware.com). Regardless of which solution you ultimately chose this is critical.

12) If you are just getting started and you are not using Service Autopilot consider buying QuickBooks day one and getting your business off to the right start financially. By the way, at http://www.lawnservicesoftware.com/ you can get free software that when you’re small will allow you to delay the purchase of QuickBooks – it will do everything you need for now.

13) Create a simple file folder structure in a small two drawer file cabinet and keep all of your paperwork and files organized. If you wait until the end of the year to record your financial records in QuickBooks and organize your bank statements and paperwork you will be miserable come tax time. This is one of the easiest ways to minimize costly tax mistakes.

14) At year end clear all of your file folders from the file cabinet and put them in a box. Start all of your file folders fresh for the new tax year. Label the box. This will help keep all of your important paper work organized by tax year.Once again, if you are not using Service Autopilot consider setting up QuickBooks so you can use their built in credit card charging functionality. Service Autopilot automates the process for you but if you are not a Service Autopilot user QuickBooks has a fairly easy to use manual process. Accepting and charging your clients credit cards is a great way to speed up your businesses cash flow and get paid fast and on time.